Mortgage in our time has become a common thing just not many have heard, but with it purchased the estate. It would seem that this is one of the types of credit, but it is unusual mortgage.

"The reverse mortgage" is a loan, but Vice versa.

Here you pay to the Bank, and he pays you. For what? Of course, for your apartment! This mechanism is available only to pensioners, usually people older than 68 years of age, who have owned liquid apartment. The papers are retired give their homes as collateral to the Bank or government entity in exchange for the loan. The loan amount depends on the period and the market value of housing. To receive money, the client may be different: the entire amount as a lump sum, monthly fixed payments (usually the lifetime is calculated at 10 years), in equal monthly payments for an indefinite period. It is worth noting that, the greater the age of the pensioner and the more expensive the apartment, the more money he can get.

In exchange for this "retirement raise" the apartment after the death of the client goes to the Bank who can sell it and recoup his costs. If the heirs are suddenly wanting to get this property back, they would have to pay the Bank the amount of "reverse mortgage", which was received by their relative.

If the pensioner survived the "allotted" time, and the amount paid was equal to the cost of housing or even more, the heirs in any way the rights to this property and not have to do anything with it can not. It is noteworthy that a "reverse mortgage" does not imply the loss of property rights to housing, this right is transferred to a legal person only after death. Even if the person survives the term "reverse mortgage", he still has the right to live in his apartment, he just ceases to pay monetary contributions. The organization stands to gain in the case where the pensioner dies before payment of the whole sum "reverse mortgage".

We came to this "miracle", as often happened, from the West. Head of the Department of Vesco Realty City

Yuri Sharanov says that we have such banking service as a "reverse mortgage" has appeared relatively recently. In 2009 JSC "Agency for restructuring of housing mortgage lending" (ARHML) was the first to introduce this practice. Initially, this organization was created in the framework of the program of state support for borrowers who find themselves in a difficult situation. In times of crisis by means of assisted those who managed to take out a mortgage, and in the conditions of economic imbalance, mass layoffs and scaled-earned boards couldn't give. The Agency has restructured the loan from such borrowers and helped with the timely payments until the employment of these "problem clients". Later ARHML began issuing "reverse mortgages" for seniors.

Best Reverse Mortgage Lenders | Best Reverse Mortgage Rates

1st Constitution Bank Reverse Mortgages

What You Should Know About Reverse Mortgages | Atlanta Tribune ...

What the Heck is a Reverse Mortgage?!? - Money Time

Reverse Mortgage FAQs | Darin Rhodes

Feds find reverse mortgage ads sow confusion

Reverse Mortgage | Atlanta Mortgage Loans – FHA and VA Loans in ...

Is a Reverse Mortgage Right for You? - Senior Providers Network

Forbes India Magazine - Reverse Mortgage: The Bank Pays you The EMI

Reverse Mortgage | First Priority Financial

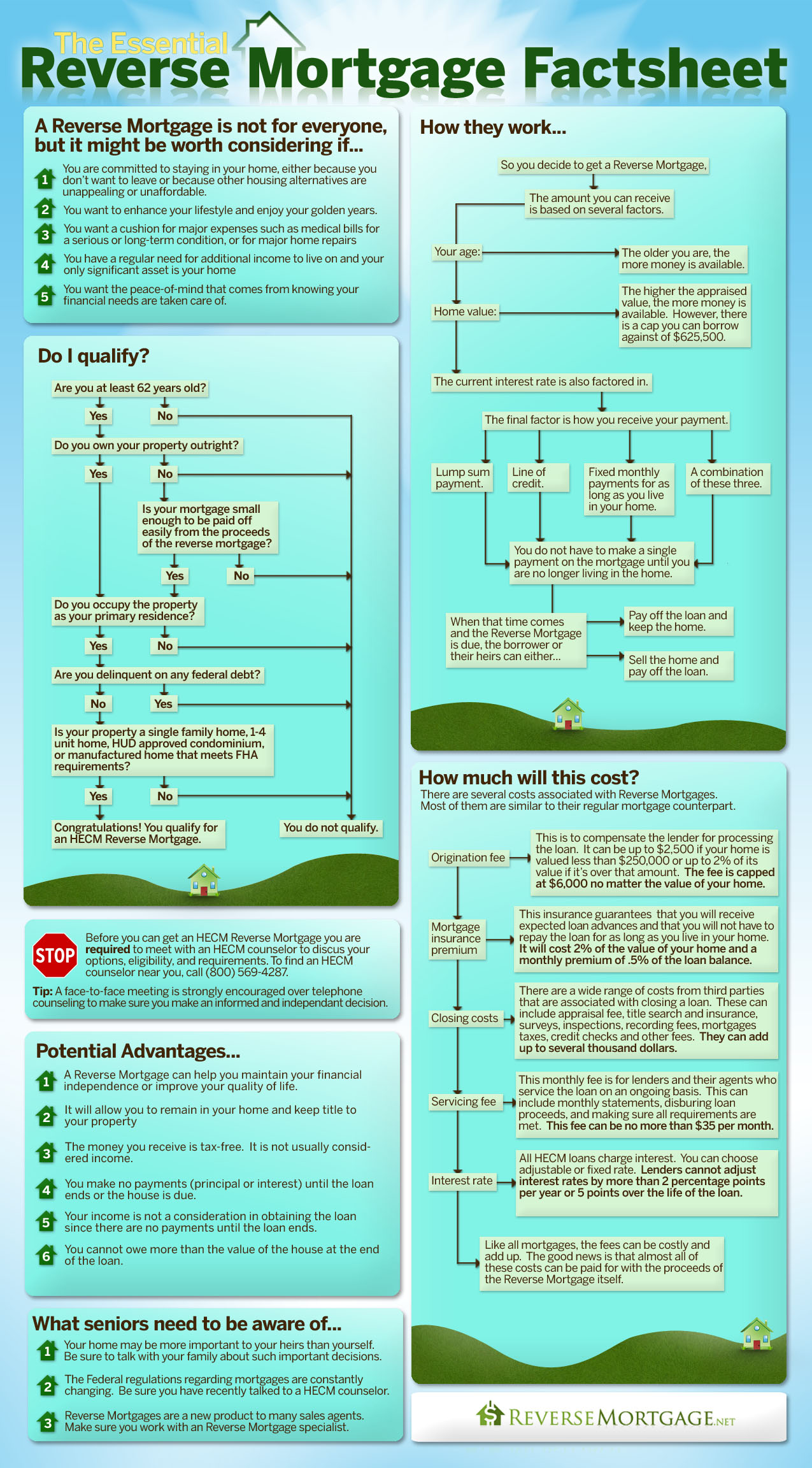

reverse-mortgage-factsheet.jpg

Straight Facts about Reverse Mortgages - shellyrobersonrealtor.com

Reverse Mortgage

Reverse Mortgage - Primary Residential Mortgage

Reverse Mortgage — Consumer Credit Counseling Service of Savannah

What You Should Know About Reverse Mortages

Reverse Mortgages by Advanced Funding of Salt Lake City, Utah

The Dangers Of A Reverse Mortgage | Investopedia

0 yorum:

Yorum Gönder