The most common are fixed mortgage rates.

They do not change during the entire term of the mortgage loan.

In addition to mortgage rates there are fixed variable interest rates. They are tied to average interest rates of the interbank market. Mortgages in foreign currency is linked to the London money market and the mortgage interest on such loans are designated as 6% of LIBOR, 7% and LIBOR etc. Floating rate loan in Euro sometimes linked to the European interbank rate and is denoted 5% EURIBOR 6% EURIBOR, etc. the Borrower took the loan with floating rate linked to LIBOR (EURIBOR), every year in your Bank learns the new value of the mortgage interest that he will pay during the year. If we are talking about a mortgage in rubles, the floating mortgage rate is tied to the Moscow market of interbank credits is defined as MosPrime3M 5% or MosPrime6M 5% and is reviewed every 3 or 6 months respectively.

There are several types of floating rate mortgages is tied to MIBOR (Moscow analogue of LIBOR), the rate of refinancing of the Central Bank, to TIBOR (Tokyo interbank exchange) - but they are not widespread. Since September 2012, the seller had offered his own version of a floating rate tied to the inflation rate in our country. Time will tell whether this version will be popular. Floating mortgage rates usually look more attractive than banks offer fixed interest mortgages.

But it should be borne in mind that market lending rates (LIBOR, MosPrime, etc.) is subject to fluctuations, and, taking out a loan with a floating rate, the borrower assumes the risk of these fluctuations. Some banks established in their programs the upper limit to which the floating rate may increase, it significantly reduces the risks of the borrower.

Another type of mortgage rates - combined. It provides for fixation of rates for the first few years of the loan, and then he starts floating interest rate. This combination may be advantageous to the borrower, if the fixed rate is below the average, and allows you to make savings ("airbag") to the time when the rate will become floating.

Making a choice in favor of low mortgage rates specified in the program, it is necessary to calculate the real mortgage interest that will have to pay.

To do this, consider the additional costs that accompany the mortgages and servicing of the mortgage loan. There are programs in which low mortgage rates combined with not the lowest actually paid the mortgage interest.

In the section "Mortgage programs" you can find the program of mortgage with minimal interest rate.

In the section "Application for credit" can be reported, what You need a loan.

If banks and mortgage brokers have suggestions that meet Your requirements, they will contact You. Applying free.

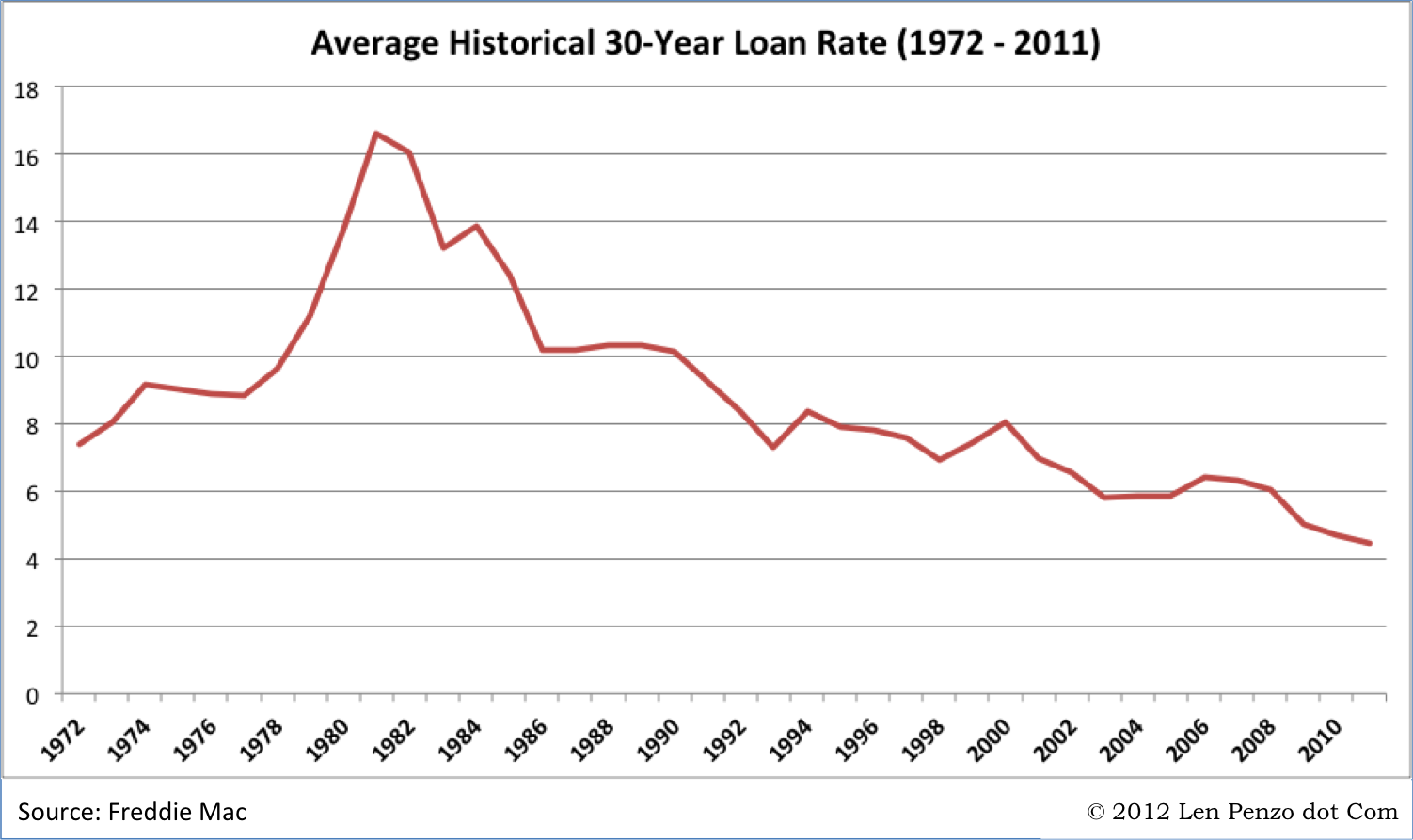

Mortgage Interest Rates: What to Expect Moving Forward

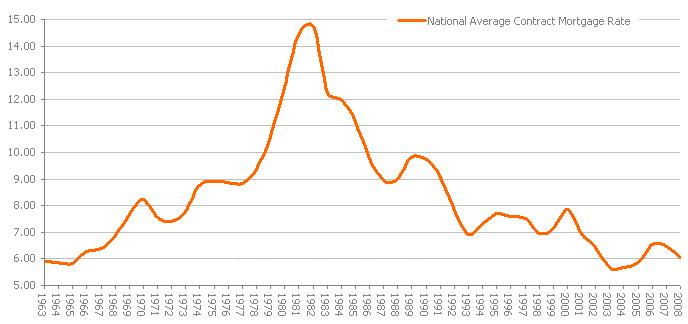

Conventional_Mortgage_Interest_Rates.JPG

Interest Rates Home Loans | TRI-SANDI SHOP

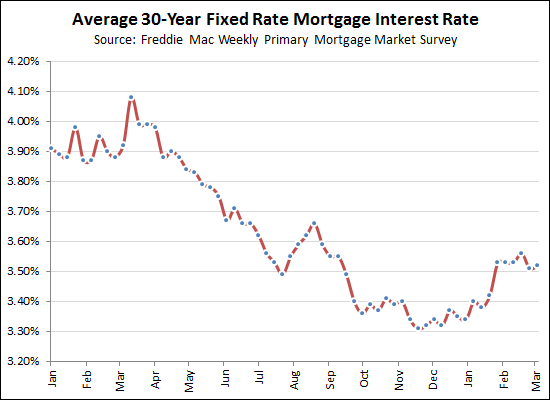

Will 30-year fixed mortgage interest rates fall below 3.5% again ...

Dust Settles, 30-Year Mortgage Interest Rates of 4.5 Percent May ...

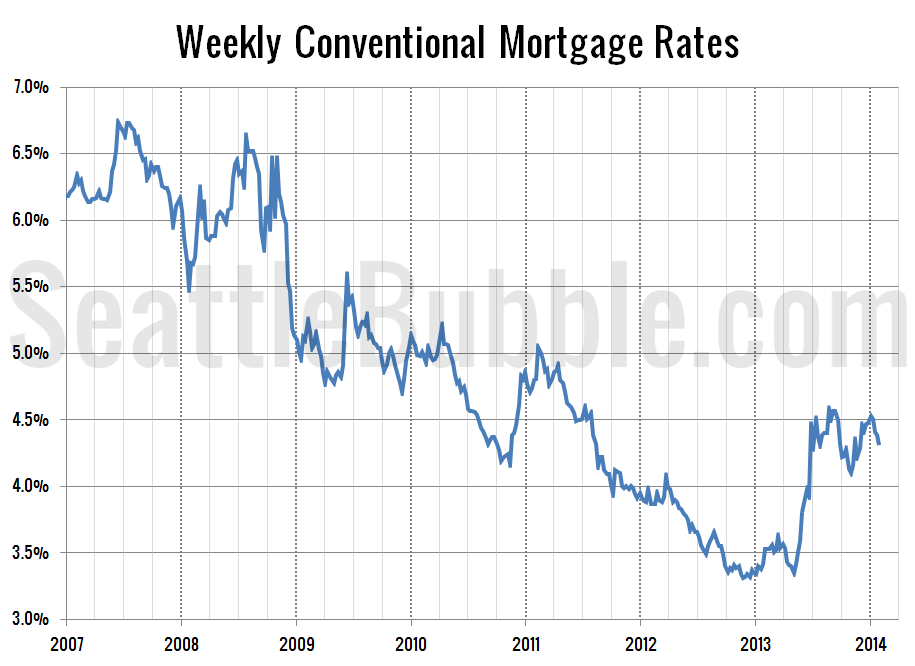

Interest Rates Dip, Consumer Confidence Climbs \u2022 Seattle Bubble

FRB: Housing Market Risks in the United Kingdom

Historical Housing Loan Interest Rates in the United States ...

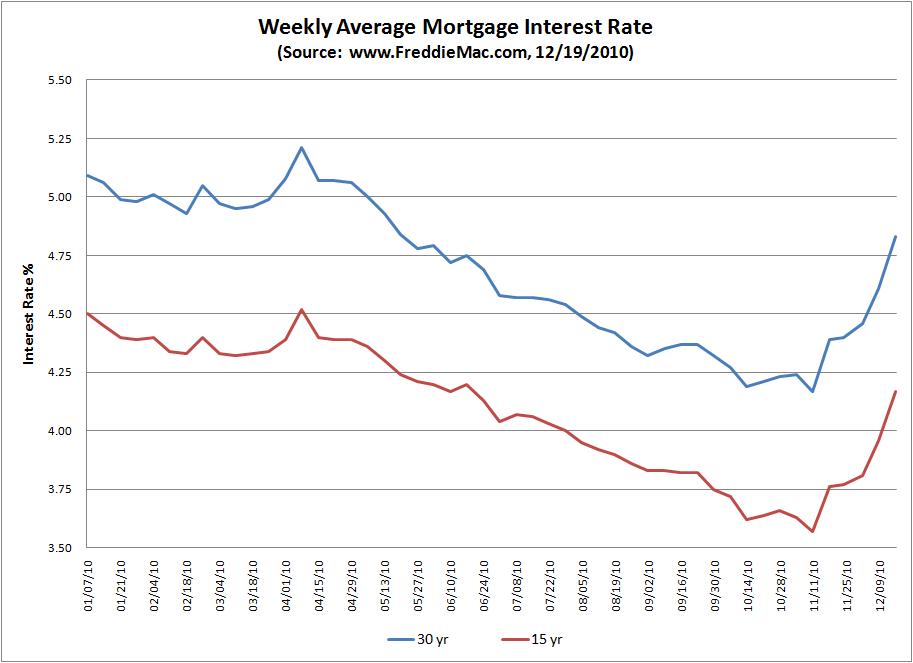

Mortgage rate predictions for 2011 | Franklin, MA, Massachusetts ...

ar12350098637115.jpg

Home Buyer Video Work Shop Florida

Mortgage interest rates remain low | Franklin, MA, Massachusetts ...

30 Year Fixed Rate Mortgage Interest Rates | Williamsburg Area ...

Base rates and bank interest rates | Economics Help

What Goes Around Comes Around: Rising Interest Rates Are ...

Steadfast Finances30 Year Mortgage Rates Over 5% Got You Down? Try ...

Shop current loan interest rates : Direct download

mortgage.jpg

0 yorum:

Yorum Gönder